The Chancellor has announced two additional property taxes for the housing market within her Autumn Budget statement, including an annual tax surcharge for properties worth more than £2 million, which some have called a “mansion tax”, alongside higher taxation rates for landlords earning rental income from properties.

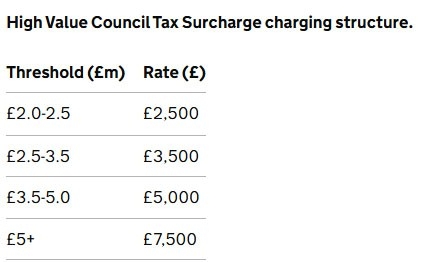

From April 2028, owners of properties identified as being valued at over £2 million will be liable for a recurring annual charge based on new thresholds (see the table below), which will be additional to the existing Council Tax liability. Charges will increase in line with inflation each year from 2029-30 onwards.

The announcement of a super Council Tax is likely to lead to some distortion at the top end of the market, particularly as the implementation date in 2028 draws closer, as was the effect of historic Stamp Duty “ceilings” in which properties above £250k saw a straight jump from 1% to a 3% rate, so buyers were offering £249,999 on properties on the market for as much as £270,000. Inevitably, sellers of homes priced around the £2 million mark will need to ask for £1.99m to attract potential buyers with a ripple effect across the wider market.

However, given all the speculation about Mansion Taxes and the possible imposition of CGT on principal residences in the run-up to the budget, on balance this is probably the least worst outcome for owners of prime property. Whilst these new measures can hardly be described as a boost, the reality is that some of the risk at the top end of the market has already been priced in over the last three to six months and any further impact on prices is, therefore, expected to be relatively modest and much less severe than it would have been in the event of one of the more onerous fiscal initiatives apparently considered. The same cannot be said of the prime second home market which is already having to contend with an increased Stamp Duty surcharge and the doubling of Council Tax in our area. Regardless, we could see a two-tiered market in which demand for higher-value properties falls even further, while the £1 – 1.9m price bracket becomes more buoyant.

Retired homeowners who benefitted from house price inflation over many years but have fixed incomes may now see these measures as an incentive to downsize.

Although landlords dodged the rumoured imposing of National Insurance on their income, they are also facing more taxes following the Chancellor’s decision to raise the basic rate of income tax for landlords by 2%, saying she wanted the ‘wealthiest to contribute the most’ and that ‘those with the broadest shoulders should pay their fair share’. From April 2027, the property basic rate will be 22%, the property higher rate will be 42% and the property additional rate will be 47%. History tells us these costs will be passed down to tenants and so despite claims of tackling cost of living pressures, the Government is pursuing a policy that will drive up rents. In the wake of these fiscal measures and regulatory changes in the Renters Rights Act, more landlords are also likely to decide to sell up which will result in fewer available rental properties and leave more renters struggling to find a property within their budget.